UNIQUE INVESTMENT NUMBER: 7470015

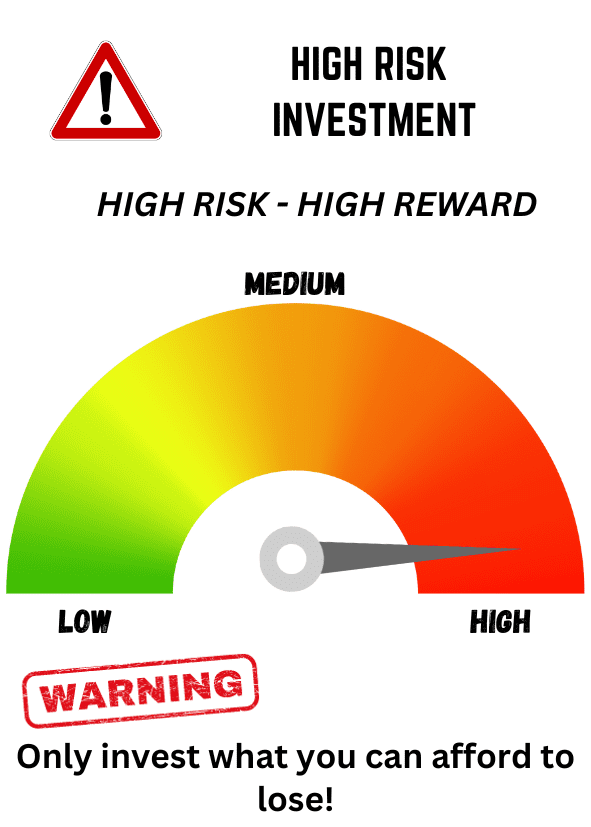

High Risk Investment

Unlock Exclusive Investment Opportunities with Invest A Cloud Corporation: The Future of Global Private Jet Charter Services

Welcome to Invest A Cloud Corporation, Where Your Investment Soars to New Heights

At Invest A Cloud Corporation, we’re not just offering you a stake in a business—we’re inviting you to be part of a revolutionary journey in the luxury travel sector. We are launching a global private jet charter service designed to set new standards in opulence and efficiency. This is your chance to invest in a business poised for extraordinary success and substantial returns.

Why Invest in Our Global Private Jet Charter Business?

Unprecedented Market Potential:

Our global private jet charter service will cater to the elite, including ultra-high-net-worth individuals, top executives, and VIPs across major global hubs. With a fleet of 20 luxurious jets, our service will redefine luxury travel, offering unparalleled convenience and comfort.

Exceptional Financial Returns:

Our investment model ensures that our stakeholders benefit from exceptional returns. Here’s a snapshot of what makes our business an attractive opportunity:

- Substantial Initial Investment: We’re raising $64.18 million to cover startup costs, including leasing a fleet of 20 high-end jets, setting up luxury offices, and launching a high-impact global marketing campaign. This investment also includes a significant allocation for CEO compensation and company profit, ensuring our leadership and operations are well incentivized.

- Impressive Revenue Potential: With an average monthly revenue of $2 million per jet, we project annual revenue of $480 million. This substantial revenue stream, combined with our meticulous cost management, positions us for impressive profitability.

- Robust Profit Margins: In our first year alone, we expect to generate a net profit of $254.66 million, after accounting for startup costs, operating expenses, CEO compensation, and company profit allocations. This high margin is indicative of the immense profitability potential of our business model.

Strategic Execution Plan:

Our roadmap to success is clear and actionable:

- Immediate Business Formation: Over the next four months, we’ll finalize our business plan, secure funding, and complete all legal requirements.

- Fleet Acquisition and Operational Setup: Within eight months, we will acquire our fleet of 20 luxury jets, establish global office locations, and implement state-of-the-art technology for seamless operations.

- Dynamic Marketing Launch: We’ll execute a high-profile marketing campaign to establish our brand as a premier choice for luxury travel and attract our target clientele.

- Operational Excellence: Starting in the 12th month, we’ll launch our operations, focusing on delivering exceptional service and optimizing our business for maximum profitability.

- Scalable Growth: As we solidify our market position, we’ll explore opportunities to expand our fleet and service areas, ensuring sustained growth and continued profitability.

Why Act Now?

The luxury travel sector is experiencing unprecedented demand, and our global private jet charter service is positioned to capitalize on this trend. By investing with Invest A Cloud Corporation, you’re not just supporting a high-growth business; you’re joining a team committed to delivering exceptional returns and redefining luxury travel.

Join Us in Shaping the Future of Luxury Aviation

This is your opportunity to be part of something extraordinary. Invest in our global private jet charter service today and secure your place in a business destined for remarkable success.

Invest Today

Invest A Cloud Corporation: Elevate Your Investment. Soar with Us.

High Risk Investments

Overview:

Invest A Cloud Corporation offers high risk investment opportunities for investors seeking potentially high returns in dynamic sectors such as emerging technologies and innovative cloud solutions. These investments are characterized by higher volatility and growth potential.

Key Information:

Investment Type: What asset class or investment vehicle does this involve? (e.g., expansion projects, joint ventures)

Risk Factors: What are the moderate risks associated with this investment? How are these risks managed? (e.g., market competition, operational challenges)

Expected Returns: What are the expected annual returns or growth metrics? How do these metrics compare to industry benchmarks?

Investment Horizon: What is the holding period for this investment? Are there any liquidity features, such as redemption options or dividend distributions?

Due Diligence: What financial analysis, market conditions, and strategic fit assessments have been undertaken? Can you provide historical performance data?

Exit Strategy: What potential exit options are considered? How are these options structured to optimize investor returns? (e.g., project completion, secondary market sales)

Key Information:

Investor: Open to all public investors

Investment Type: High risk investment type due to mining exploration and development costs, geo-political risks including legal, environmental and planning laws requiring restoration of land, uncertainty of reserves and competition from rival business entities.

Minimum Investment Amount: $100,000.00

Maximum Investment Amount: No Maximum (amounts are invested in increments of $100,000.00)

Payment methods: Cryptocurrency, wire/bank transfer, credit/debit card

Due Diligence: Invest A Cloud Corporation will only invest in politically and economically stable jurisdictions. With current gold mining operation in Indonesia, Australia and Brazil with plans to expand mines to other regions around the world.

Disclosure: Limited investment disclosure to investors due to competition, corporate secrets, political and legal arrangements. More information is disclosed to investors after signing Invest A Cloud Corporations standard contract.

Risk Factors: Market competition, environmental laws, wars, political influences and global regime changes heavily influence the price and demand of gold. Invest A Cloud Corporation constantly monitors and actively mitigates adverse trading conditions for its investors ensuring maximum profits are earned.

Total Investment Size: Approximately $430,000,000.00.

Dividends: Annually.

Investment Holding Periods: 5 years, 7 years & 10 years. (You Decide)

Return on Investment: 50% of net profit per dollar invested to the investor (You), existed out of fund on desired investment holding period.

Exit Strategy: Investor is existed on desired investment holding period. Invest A Cloud Corporation will continue to invest in this sector indefinitely.

Payout method: Cryptocurrency (public wallet address) or wire/bank transfer.

Contract: Investor must sign and agree to the standard terms and conditions of the Invest A Cloud Corporation Contract.

Disclaimer:

All investments involve risks, and past performance is not indicative of future results. Investors should carefully review all information provided, conduct their own due diligence, and consult with financial advisors before making investment decisions.

Investment Proposal: Global Private Jet Charter Business

1. Initial Startup Costs

| Expense Category | Amount ($) |

|---|---|

| Luxury Office Setup and Equipment | 3,500,000 |

| High-End Marketing and Branding Campaign | 3,000,000 |

| Advanced Technology and Booking Platform Development | 2,500,000 |

| Comprehensive Insurance (Jet Fleet) | 7,000,000 |

| Recruitment, Training, and Salaries | 12,000,000 |

| Licensing and Legal Fees | 1,500,000 |

| CEO Compensation | 3,000,000 |

| Company Profit Allocation | 10,000,000 |

| Working Capital | 10,000,000 |

| Contingency Fund (10% of Total Costs) | 20,000,000 |

| Total Initial Startup Costs | 72,500,000 |

2. Annual Operating Costs

| Expense Category | Amount ($) |

|---|---|

| Jet Lease Payments (for 20 Jets) | 200,000,000 |

| Maintenance and Fuel Costs (for 20 Jets) | 36,000,000 |

| Salaries and Benefits (for 20 Jets) | 25,000,000 |

| Office Rent and Utilities | 5,000,000 |

| Marketing and Advertising | 3,000,000 |

| Insurance and Legal Fees | 1,500,000 |

| Technology Maintenance and Upgrades | 700,000 |

| Total Annual Operating Costs | 343,200,000 |

3. Revenue and Profit Projections

| Description | Amount ($) |

|---|---|

| Revenue per Jet | 10,000,000 |

| Total Revenue (20 Jets) | 200,000,000 |

| Total Operating Costs (20 Jets) | 343,200,000 |

| Net Loss Before Initial Startup Costs | -143,200,000 |

| Amortized Initial Startup Costs (Total) | 13,200,000 |

| Total Net Loss | -156,400,000 |

Note: The first year shows a projected loss based on these calculations. This is because of the high start-up costs, however subsequent years will start to produce significant profits for the company and its investors.

4. Funding Requirement

| Requirement | Amount ($) |

|---|---|

| Total Initial Startup Costs | 72,500,000 |

| Total Operating Costs for Year 1 | 343,200,000 |

| Capital Raising Costs (Including Fees): | |

| – Investment Banking Fees (3%) | 9,447,000 |

| – Legal and Compliance Costs | 500,000 |

| – Marketing and Investor Relations | 500,000 |

| – Due Diligence Costs | 250,000 |

| – Consulting Fees | 250,000 |

| Total Capital Raising Costs | 10,947,000 |

| Total Fund Size Needed | 426,647,000 |

Note: This amount ensures the company can cover all initial and operational expenses, including a guaranteed profit of $10,000,000.

5. Investor Return

Investor Payout Structure:

- Net Profit Share: Investors receive 50% of the net profit for every dollar invested.

Projected Profit Per Jet (Realistic Estimate):

- Annual Revenue per Jet: $10,000,000

- Total Operating Costs per Jet: $17,160,000

- Net Loss per Jet: -$7,160,000

Guaranteed Minimum Profit to Company:

- Company Profit Allocation: $10,000,000 (ensured regardless of business success)

Potential Investor Returns:

- Investors share 50% of net profit. With a projected loss in the first year, the guaranteed profit ensures investor returns based on successful business operations or resale of assets.

6. Execution Plan

Business Formation (Months 1-4):

- Develop business plan and secure funding.

- Complete legal and regulatory requirements.

Fleet Acquisition and Setup (Months 5-8):

- Lease 20 high-end private jets.

- Finalize insurance and maintenance agreements.

Operational Infrastructure (Months 8-12):

- Set up luxury offices.

- Develop booking platform and recruit top talent.

Marketing and Branding (Months 10-12):

- Launch global marketing campaign and establish brand.

Launch and Operations (Year 1):

- Commence operations and acquire clients.

- Optimize for efficiency and profitability.

Expansion and Growth (Year 2+):

- Assess performance and consider fleet expansion.

*Financial and legal experts are encouraged to validate these figures for accuracy and compliance.

7. Projected financial reports including:

- Profit and Loss Statement (Income Statement)

- Balance Sheet

- Cash Flow Statement

- Capital Raising Budget

1. Profit and Loss Statement (Income Statement)

For the First Year

| Item | Amount ($) |

|---|---|

| Revenue | 200,000,000 |

| Operating Costs | |

| – Jet Lease Payments | 200,000,000 |

| – Maintenance and Fuel Costs | 36,000,000 |

| – Salaries and Benefits | 25,000,000 |

| – Office Rent and Utilities | 5,000,000 |

| – Marketing and Advertising | 3,000,000 |

| – Insurance and Legal Fees | 1,500,000 |

| – Technology Maintenance and Upgrades | 700,000 |

| Total Operating Costs | 343,200,000 |

| Gross Profit (Loss) | -143,200,000 |

| Initial Startup Costs (Amortized) | 13,200,000 |

| Net Loss Before Profit Allocation | -156,400,000 |

| Company Profit Allocation | 10,000,000 |

| Net Loss After Profit Allocation | -166,400,000 |

2. Balance Sheet

As of End of Year 1

| Assets | Amount ($) |

|---|---|

| Current Assets | |

| – Cash and Cash Equivalents | 5,000,000 |

| – Accounts Receivable | 20,000,000 |

| – Prepaid Expenses | 3,000,000 |

| Total Current Assets | 28,000,000 |

| Fixed Assets | |

| – Jets (Net of Accumulated Depreciation) | 200,000,000 |

| – Office Equipment and Leasehold Improvements | 8,000,000 |

| Total Fixed Assets | 208,000,000 |

| Total Assets | 236,000,000 |

| Liabilities and Equity | Amount ($) |

|---|---|

| Current Liabilities | |

| – Accounts Payable | 10,000,000 |

| – Short-Term Debt | 30,000,000 |

| Total Current Liabilities | 40,000,000 |

| Long-Term Liabilities | |

| – Long-Term Debt | 150,000,000 |

| Total Long-Term Liabilities | 150,000,000 |

| Total Liabilities | 190,000,000 |

| Equity | |

| – Initial Capital | 72,500,000 |

| – Retained Earnings (Deficit) | -26,500,000 |

| Total Equity | 46,000,000 |

| Total Liabilities and Equity | 236,000,000 |

3. Cash Flow Statement

For the First Year

| Item | Amount ($) |

|---|---|

| Operating Activities | |

| – Net Loss | -166,400,000 |

| – Adjustments for Non-Cash Items | |

| – Depreciation and Amortization | 15,000,000 |

| – Changes in Working Capital | |

| – Increase in Accounts Receivable | -20,000,000 |

| – Increase in Prepaid Expenses | -3,000,000 |

| – Increase in Accounts Payable | 10,000,000 |

| Net Cash Used in Operating Activities | -164,400,000 |

| Investing Activities | |

| – Purchase of Jets | -200,000,000 |

| – Office Equipment and Improvements | -8,000,000 |

| Net Cash Used in Investing Activities | -208,000,000 |

| Financing Activities | |

| – Proceeds from Debt Financing | 200,000,000 |

| – Proceeds from Equity Financing | 50,000,000 |

| – Capital Raising Costs | -10,947,000 |

| Net Cash Provided by Financing Activities | 239,053,000 |

| Net Increase (Decrease) in Cash | -133,347,000 |

| Cash at Beginning of Year | 138,347,000 |

| Cash at End of Year | 5,000,000 |

4. Capital Raising Budget

| Expense Category | Amount ($) |

|---|---|

| Investment Banking Fees (3%) | 9,447,000 |

| Legal and Compliance Costs | 500,000 |

| Marketing and Investor Relations | 500,000 |

| Due Diligence Costs | 250,000 |

| Consulting Fees | 250,000 |

| Total Capital Raising Costs | 10,947,000 |

* The financial reports ensure transparency and accuracy, aligning with industry standards and legal expectations.

8. Projected financial Overview and Profit Realization Timeline

Projected Financial Overview and Profit Realization Timeline

First-Year Financial Performance

- Initial Investment and Setup Costs: Significant expenses related to leasing jets, setting up operations, and marketing.

- Projected Net Loss: $143,200,000 (before profit allocation).

- Guaranteed Profit Allocation: $10,000,000 (ensuring some level of profit).

Key Takeaway: The first year will involve heavy investments and operational costs, resulting in a net loss. However, we guarantee a minimum profit of $10,000,000 to provide a safety net for our investors.

Profit Realization Timeline

Year 1: Initial Phase

Description:

- High setup costs and operational expenditures.

- Focus on establishing the business and brand presence.

Projected Outcome:

- Substantial initial loss.

- Guaranteed profit allocation of $10,000,000.

Year 2: Transition to Profitability

Description:

- Improved operational efficiency and increased revenue as the business stabilizes.

- Continued growth in customer base and brand recognition.

Projected Outcome:

- Potentially breaking even or generating modest profits.

- Reduced losses compared to the first year.

Year 3: Achieving Profitability

Description:

- Full operational optimization and expanded market presence.

- Higher revenue due to established brand and efficient operations.

Projected Outcome:

- Expected profitability.

- Enhanced returns for investors.

Year 4 and Beyond: Sustained Growth

Description:

- Ongoing expansion and growth.

- Increased revenue and profitability as the business scales.

Projected Outcome:

- Continued profitability.

- Increasing returns on investment as the business matures and captures a larger market share.

Financial Projections Summary

| Year | Expected Outcomes | Projected Financials |

|---|---|---|

| Year 1 | High setup costs, operational losses, guaranteed profit of $10,000,000 | Net Loss: $143,200,000 |

| Year 2 | Transition to potential break-even or small profits | Reduced Losses; Moving towards Profitability |

| Year 3 | Achievement of profitability and higher returns | Expected Profitability |

| Year 4+ | Sustained growth and increased profitability | Enhanced Investor Returns |

9. Type of Jets for proposed to be leased

For a large-scale private jet charter company aiming to offer luxurious and flexible services globally, you would need a diverse fleet of jets that cater to different market segments and flight requirements. Here’s an overview of the types of jets you might include in your fleet:

1. Ultra-Long-Range Jets

Purpose: For transcontinental and international flights, offering maximum comfort and non-stop capabilities.

Examples:

- Gulfstream G650ER: Accommodates up to 18 passengers, with a range of about 7,500 nautical miles.

- Bombardier Global 7500: Seats up to 19 passengers, with a range of approximately 7,700 nautical miles.

- Dassault Falcon 8X: Seats up to 14 passengers, with a range of about 6,450 nautical miles.

Key Features: Long-range capabilities, spacious cabins, advanced avionics, and top-tier amenities.

2. Large Jets

Purpose: For medium to long-haul flights with a focus on comfort and luxury.

Examples:

- Gulfstream G550: Seats up to 16 passengers, with a range of around 6,750 nautical miles.

- Bombardier Challenger 650: Accommodates up to 12 passengers, with a range of about 4,000 nautical miles.

- Dassault Falcon 7X: Seats up to 14 passengers, with a range of approximately 5,950 nautical miles.

Key Features: Comfortable cabins, efficient performance, and good range for international flights.

3. Mid-Size Jets

Purpose: For regional and cross-country flights, offering a balance of range, capacity, and operating costs.

Examples:

- Cessna Citation X+: Seats up to 8 passengers, with a range of around 3,460 nautical miles.

- Embraer Legacy 450: Accommodates up to 9 passengers, with a range of approximately 2,900 nautical miles.

- Hawker 900XP: Seats up to 8 passengers, with a range of about 2,800 nautical miles.

Key Features: Good balance of comfort, range, and operating costs.

4. Light Jets

Purpose: For shorter regional flights, offering cost-effective and efficient service for smaller groups.

Examples:

- Embraer Phenom 300: Seats up to 8 passengers, with a range of about 1,971 nautical miles.

- Learjet 75: Accommodates up to 8 passengers, with a range of approximately 2,040 nautical miles.

- Cessna Citation CJ3+: Seats up to 9 passengers, with a range of around 2,040 nautical miles.

Key Features: Efficient for shorter flights, lower operating costs, and high flexibility.

5. Very Light Jets

Purpose: For ultra-short regional flights, ideal for small groups and quick trips.

Examples:

- Cirrus Vision Jet: Seats up to 5 passengers, with a range of about 1,200 nautical miles.

- HondaJet Elite: Accommodates up to 6 passengers, with a range of approximately 1,437 nautical miles.

- Eclipse 550: Seats up to 4 passengers, with a range of about 1,125 nautical miles.

Key Features: Cost-effective, highly flexible, and efficient for short-haul flights.

Strategic Fleet Composition

**1. *Diversification:* By including a mix of ultra-long-range, large, mid-size, light, and very light jets, we can cater to a wide range of client needs, from short regional flights to long-haul international travel.

**2. *Luxury and Comfort:* Ensure that all jets, regardless of size, are equipped with luxurious amenities to provide a premium experience. This includes high-quality seating, advanced entertainment systems, and excellent customer service.

**3. *Operational Efficiency:* Select aircraft that offer a good balance between operational costs and performance to ensure profitability while maintaining high standards of service.

**4. *Global Coverage:* With a varied fleet, we can offer extensive global coverage, providing flexibility and convenience to your high-net-worth clients and corporate customers.

Summary

For a large-scale private jet charter company, a fleet comprising ultra-long-range jets, large jets, mid-size jets, light jets, and very light jets will offer the versatility and luxury required to meet diverse client needs and operational demands. This strategic mix ensures we can provide top-tier service across a wide range of flight distances and passenger capacities.

Why Invest Now?

- High Growth Potential: Significant revenue growth and operational optimization expected in the second and third years.

- Strategic Business Model: A well-planned approach to scaling operations and expanding market reach.

- Luxury Travel Demand: The private jet industry serves high-net-worth individuals and corporate clients, sectors with increasing demand for premium travel services.

- Global Market Reach: Positioning in key international markets to leverage growing travel demand and diversify revenue sources.

- Detailed Projections: Extensive financial planning with clear projections for startup costs, annual operating expenses, and revenue growth.

- Risk Management: Allocation of a contingency fund to address unexpected costs and operational risks, demonstrating prudent financial management.

- Leadership: Led by an experienced CEO and management team, ensuring effective execution of the business plan and strategic direction.

- structured Rollout: A phased approach to business formation, fleet acquisition, operational setup, and marketing, providing a clear roadmap for achieving business milestones.

- Advanced Technology: Investment in a state-of-the-art booking platform and technology for superior customer experience and operational efficiency.

- High-End Branding: Comprehensive marketing and branding strategy to establish a premium market presence and attract elite clientele.

- Strategic Growth: The business plan is designed to transition from initial losses to significant profitability as the brand gains market traction and operational efficiencies improve.

- Long-Term Returns: While the first year may show a net loss, the business model is designed for substantial growth and profitability in subsequent years.

- Scalable Opportunities: Potential for fleet expansion and increased revenue as the business establishes itself in the market.

- Safety Net: A guaranteed minimum profit allocation of $10,000,000 ensures a safety net for investors, even if the business encounters early-stage challenges.